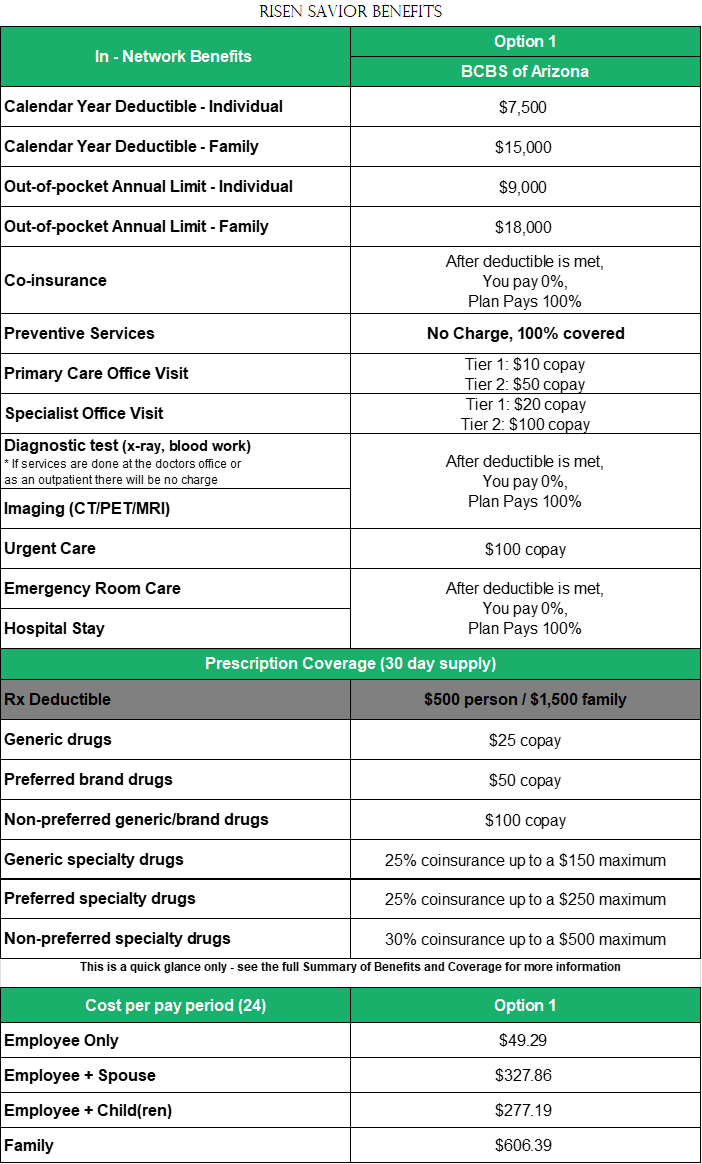

* For providers outside of Arizona, use the First Health network.

Select the plan below to review the full Summary of Benefits and Coverage

CHECK OUT THE WIDE RANGE OF SERVICE OPTIONS AVAILABLE TO MEMBERS

CURRENTLY ENROLLED IN EITHER OF THE EMIHEALTH PLANS

REGISTER ON EMIHEALTH.COM

ONCE YOU DO, YOU CAN LOG IN ANYTIME, ANYWHERE

YOUR GUIDE TO UNDERSTANDING WHAT IT IS AND WHAT’S COVERED

The following AFLAC insurance polices are available to employees

![]()

For more information about policy benefits, limitations, and

exclusions, please call your Aflac insurance agent/producer,

Jennifer Goedken, at (480) 773-2068 or email

jennifer_goedken@us.aflac.com

This is a brief product overview only.

Flexible Spending Account (FSA)

Limit: $3,300

A Flexible Spending Account (FSA) is a special account you put money into that you use to pay for certain out-of-pocket health care costs. You don’t pay taxes on this money. This means you’ll save an amount equal to the taxes you would have paid on the money you set aside. The amount that you elect will be deducted from your paycheck over 24 pay periods, however, you will be able to utilize the funds as of January 1st.

Dependent Care Account (DCA)

Limit: $2,500/$5,000

A Dependent Care Reimbursement Account (DCA) can be used to reimburse for eligible daycare expenses for children age 12 and under or for adult daycare expenses for a disabled spouse or IRS tax dependent. The maximum annual deduction is $5000 (or $2500 if married and filing separately). The amount you elect will be deducted equally from your paycheck over 24 pay periods and will not be available for use until it is deposited into your account.

Health Reimbursement Account (HRA)

Risen Savior provides two different HRA plans to assist employees who elect the Health plan with medical costs.

HRA – Co-Pays

Risen Savior will pay up to $1,000 (single insured)/$2,000 (2 or more insured)

towards Office Co-Pays and Rx prescriptions each year.

HRA – Deductible

After the first $2,000 of an individual’s deductible is met,

Risen Savior will pay the next $3,750 per individual towards their deductible up to a family maximum of $7,500.

All of these plans are administered through Infinisource.

Please see the human resource representative (Susan Mello) for additional information.

CAN I MAKE MID-YEAR PLAN CHANGES TO MY GROUP HEALTH INSURANCE?

An employer’s ability to allow employees to cancel or change health plan elections is governed by the Internal Revenue Code. Section 125 of the Internal Revenue Code (IRC) governs how employers provide benefits to employees on a pre-tax basis. After an employee has made an initial enrollment election, Section 125 does not permit changes outside of yearly open enrollment except for certain, specific reasons. The permitted Section 125 changes are the qualified “change-of-status” events described below:

QUALIFYING LIFE EVENT (QLE)

A change in your situation — like getting married, having a baby, or losing health coverage — that can make you eligible for a Special Enrollment Period, allowing you to enroll in health insurance outside the yearly Open Enrollment Period.

There are 4 basic types of qualifying life events. (The following are examples, not a full list.)

- Loss of health coverage

-

- Losing existing health coverage, including job-based, individual, and student plans

- Losing eligibility for Medicare, Medicaid, or CHIP

- Turning 26 and losing coverage through a parent’s plan

- Changes in household

-

- Getting married or divorced

- Having a baby or adopting a child

- Death in the family

- Changes in residence

-

- Moving to a different ZIP code or county

- A student moving to or from the place they attend school

- A seasonal worker moving to or from the place they both live and work

- Moving to or from a shelter or other transitional housing

- Other qualifying events

-

- Changes in your income that affect the coverage you qualify for

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder

- Becoming a U.S. citizen

- Leaving incarceration (jail or prison)

- AmeriCorps members starting or ending their service

- See all qualifying life events

IMPORTANT PATIENT PROTECTION AND AFFORDABLE CARE ACT NOTICES, ERISA NOTICES AND CONTACTS FOR MORE INFORMATION

Your Employer is providing these important notices to you at no fee. The notices in this package describe important rights that you have under the terms of the Group Health Plan. If you have any questions or need additional information regarding these notices you can contact:

Your Employer Representative

Susan Mello

480-802-1505

susan.mello@rslcs.org

or by mail at

23914 S. Alma School Rd.

Chandler, AZ 85248