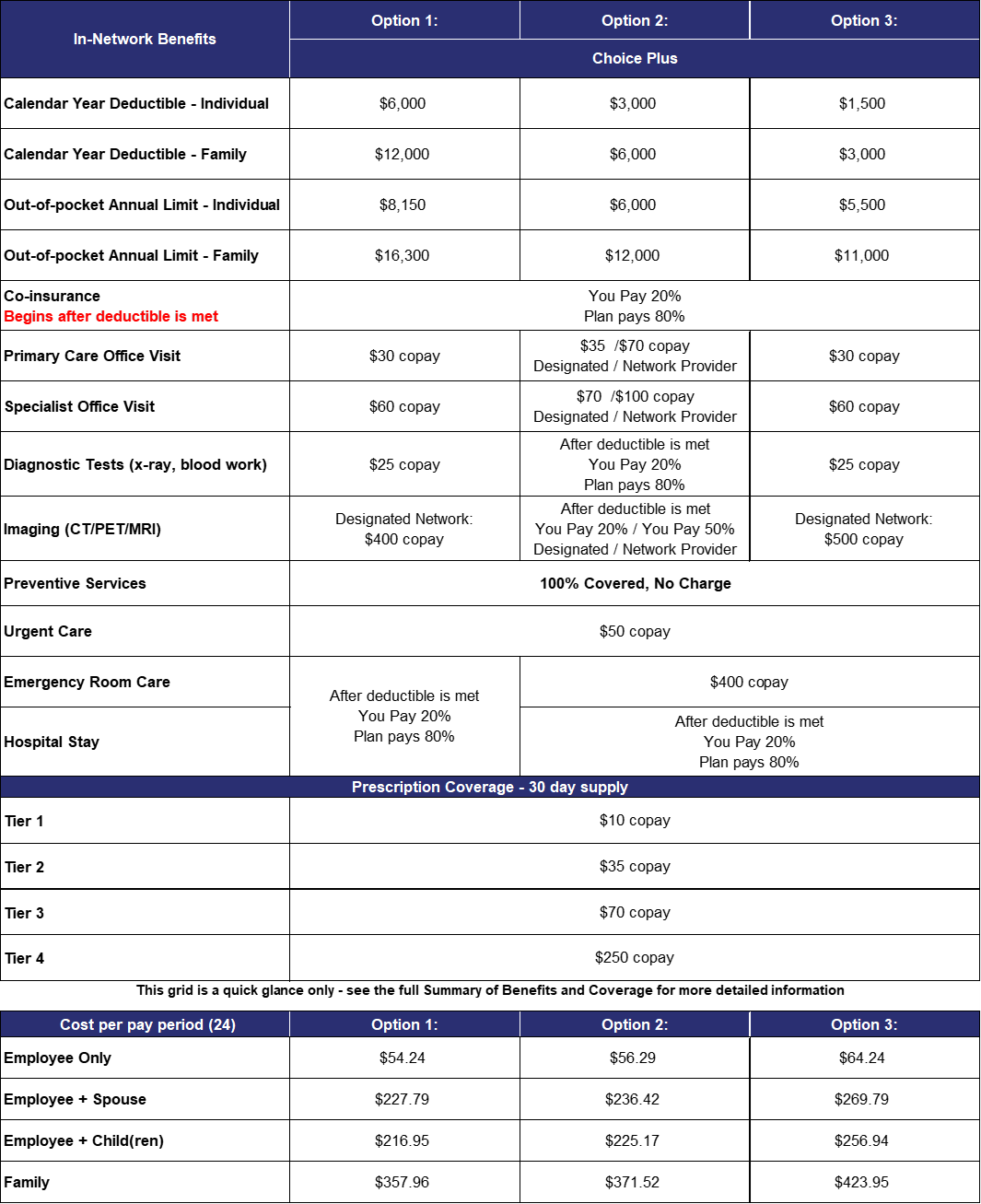

Triax will contribute 80% towards the monthly Employee Only medical premiums, and 60% towards all other tiers.

There are 3 medical plans, choose the plan that works best for you.

Company Sponsored Term Life and AD&D

$30,000

Basic Life and AD&D

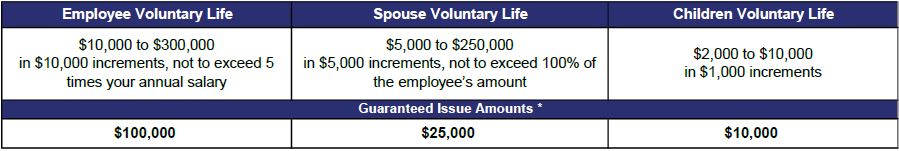

Optional Voluntary Term Life – Premiums are age rated

*Guaranteed issue amounts only apply when you are first eligible for benefits.

*Evidence of Insurability Form required for any amounts over the guarantee issue amount,

or for any employee adding coverage after they are first eligible.

Complete and Submit the Form in the link below – Triax Group ID Number is C8Y5

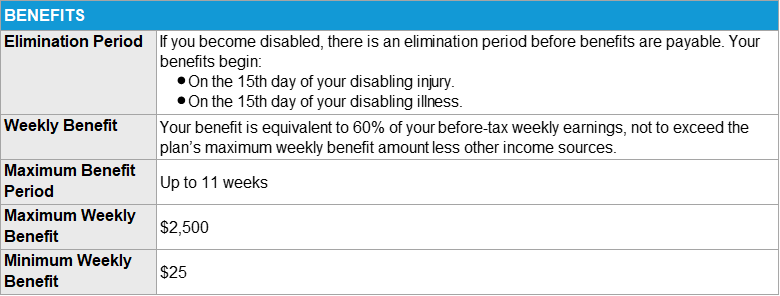

Company Sponsored Short Term Disability

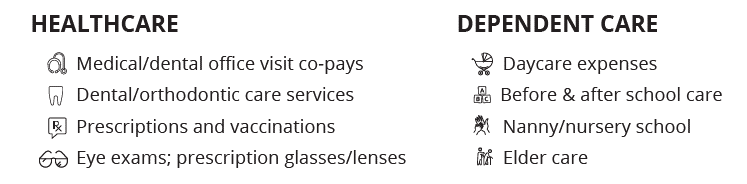

An FSA Account with TASC lets you set aside pretax dollars to pay for expenses

Plan year is 1/1/2024 – 12/31/2024

![]()

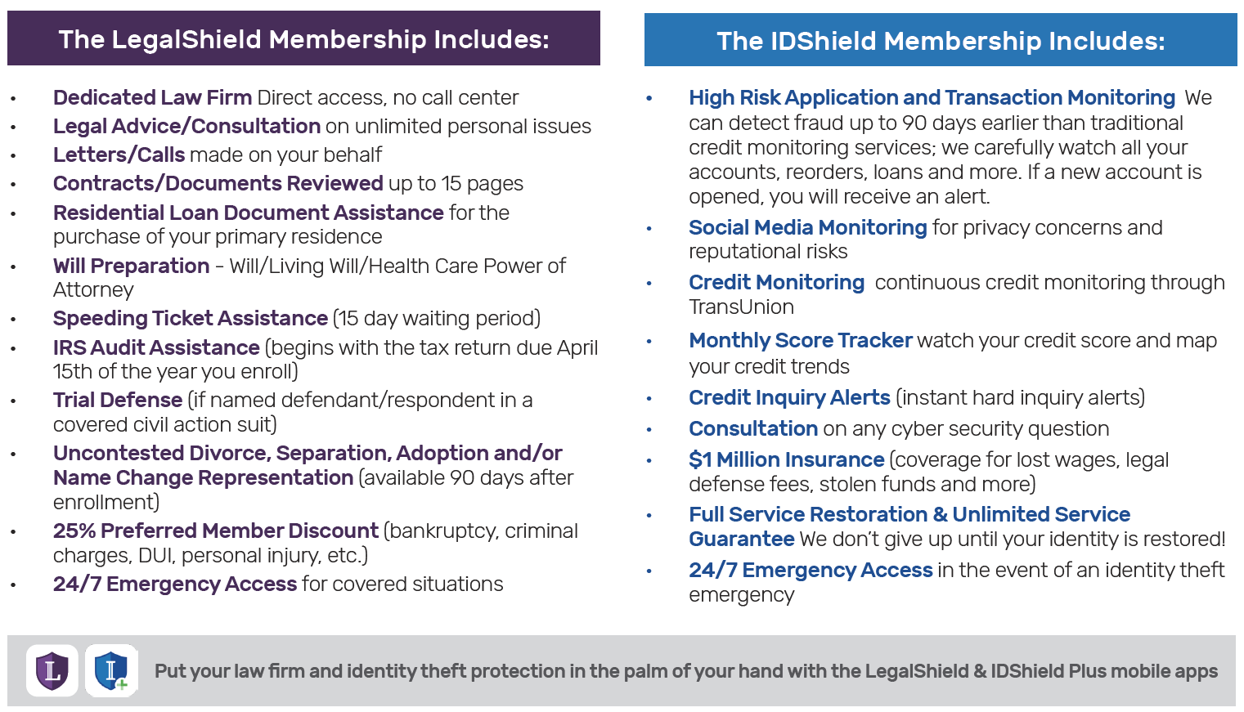

HELP PROTECT YOUR LIFESTYLE.

Your current insurance may cover most things, but it may not cover everything. Aflac’s

cash benefits can help protect your family in the event of an unexpected loss.

The following Assurity insurance polices are available to employees

FOR ADDITIONAL PLAN INFORMATION AND TO ENROLL PLEASE CONTACT

Jennifer Goedken

An Independent Agent Representing Assuirty

(480) 773-2068 – Phone

(480) 347-0801 – Fax

jennifer@benefitsgallery.com

CAN I MAKE MID-YEAR PLAN CHANGES TO MY GROUP HEALTH INSURANCE?

An employer’s ability to allow employees to cancel or change health plan elections is governed by the Internal Revenue Code. Section 125 of the Internal Revenue Code (IRC) governs how employers provide benefits to employees on a pre-tax basis. After an employee has made an initial enrollment election, Section 125 does not permit changes outside of yearly open enrollment except for certain, specific reasons. The permitted Section 125 changes are the qualified “change-of-status” events described below:

Qualifying Life Event (QLE)

A change in your situation — like getting married, having a baby, or losing health coverage — that can make you eligible for a Special Enrollment Period, allowing you to enroll in health insurance outside the yearly Open Enrollment Period.

There are 4 basic types of qualifying life events. (The following are examples, not a full list.)

- Loss of health coverage

-

- Losing existing health coverage, including job-based, individual, and student plans

- Losing eligibility for Medicare, Medicaid, or CHIP

- Turning 26 and losing coverage through a parent’s plan

- Changes in household

-

- Getting married or divorced

- Having a baby or adopting a child

- Death in the family

- Changes in residence

-

- Moving to a different ZIP code or county

- A student moving to or from the place they attend school

- A seasonal worker moving to or from the place they both live and work

- Moving to or from a shelter or other transitional housing

- Other qualifying events

-

- Changes in your income that affect the coverage you qualify for

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder

- Becoming a U.S. citizen

- Leaving incarceration (jail or prison)

- AmeriCorps members starting or ending their service

- See all qualifying life events

IMPORTANT PATIENT PROTECTION AND AFFORDABLE CARE ACT NOTICES, ERISA NOTICES AND CONTACTS FOR MORE INFORMATION

Triax Industries, LLC is providing these important notices to you at no fee. The notices in this package describe important rights that you have under the terms of the Triax Industries, LLC Group Health Plan. If you have any questions or need additional information regarding these notices you can contact:

Your Employer Representative

Robyn Gray

480-449-5782

rgray@triaxindustries.com

or by mail at

6519 W Allison Rd

Chandler, AZ 85226