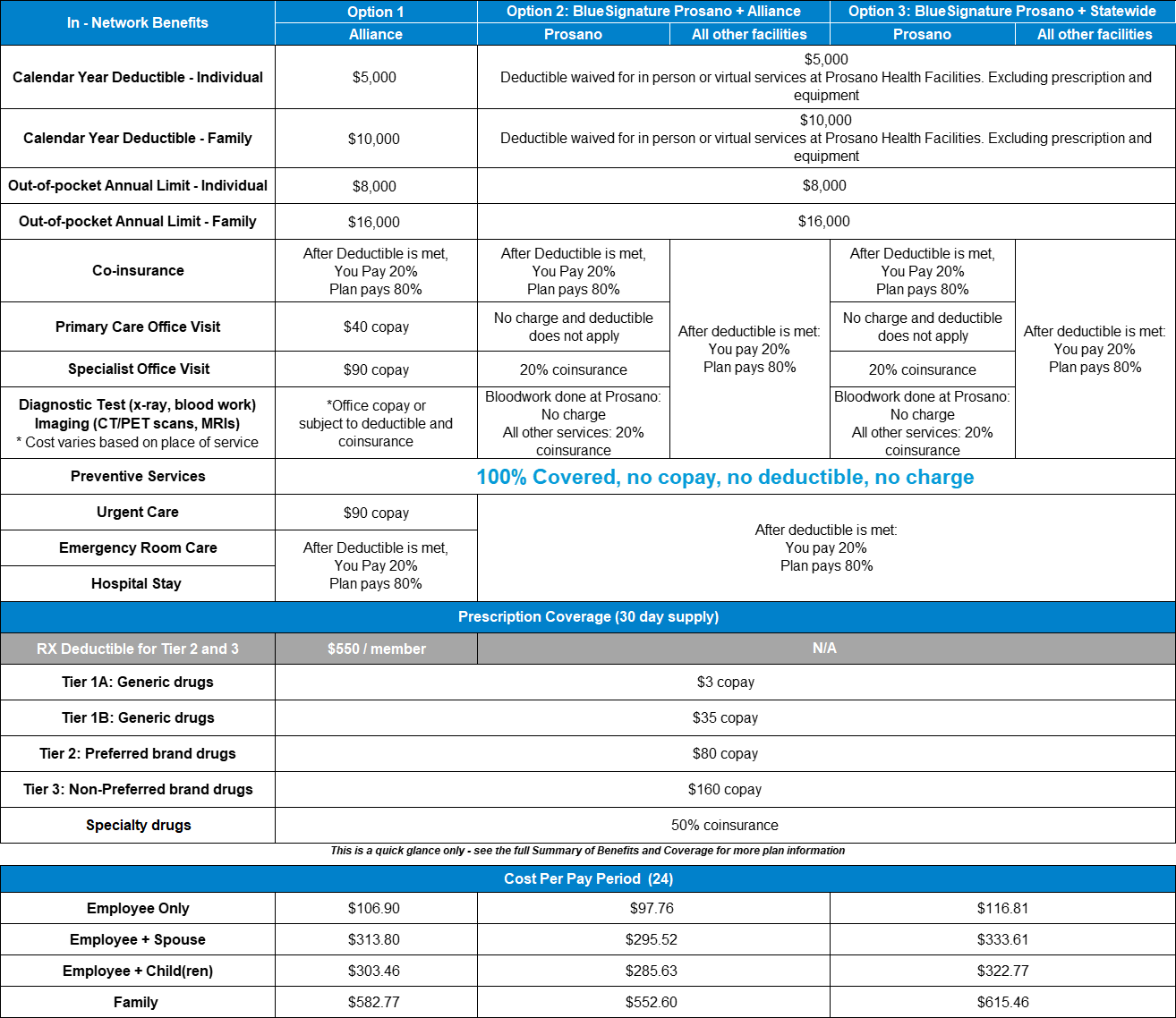

For additional information about the Blue Cross Blue Sheild’s Prosano medical plan, please click the below button.

Additional added benefits for employees and dependents enrolled in either one of the Medical Plans

Get these answers to health questions and more with Nurse on Call and BlueCare Anywhere:

![]()

There is no deductible to meet and you cannot exhaust your benefits since there is no annual plan maximum

If you visit a Participating Dentist, you will be responsible to pay the covered service copayment to the contracted

DPPO Dental Provider. However if covered services are provided Out-of-Network by a non-Participating Dentist, TDA will pay the Provider the Plan Allowance and you may be billed and responsible for any difference between the billed amount and the TDA Plan Allowance.

![]()

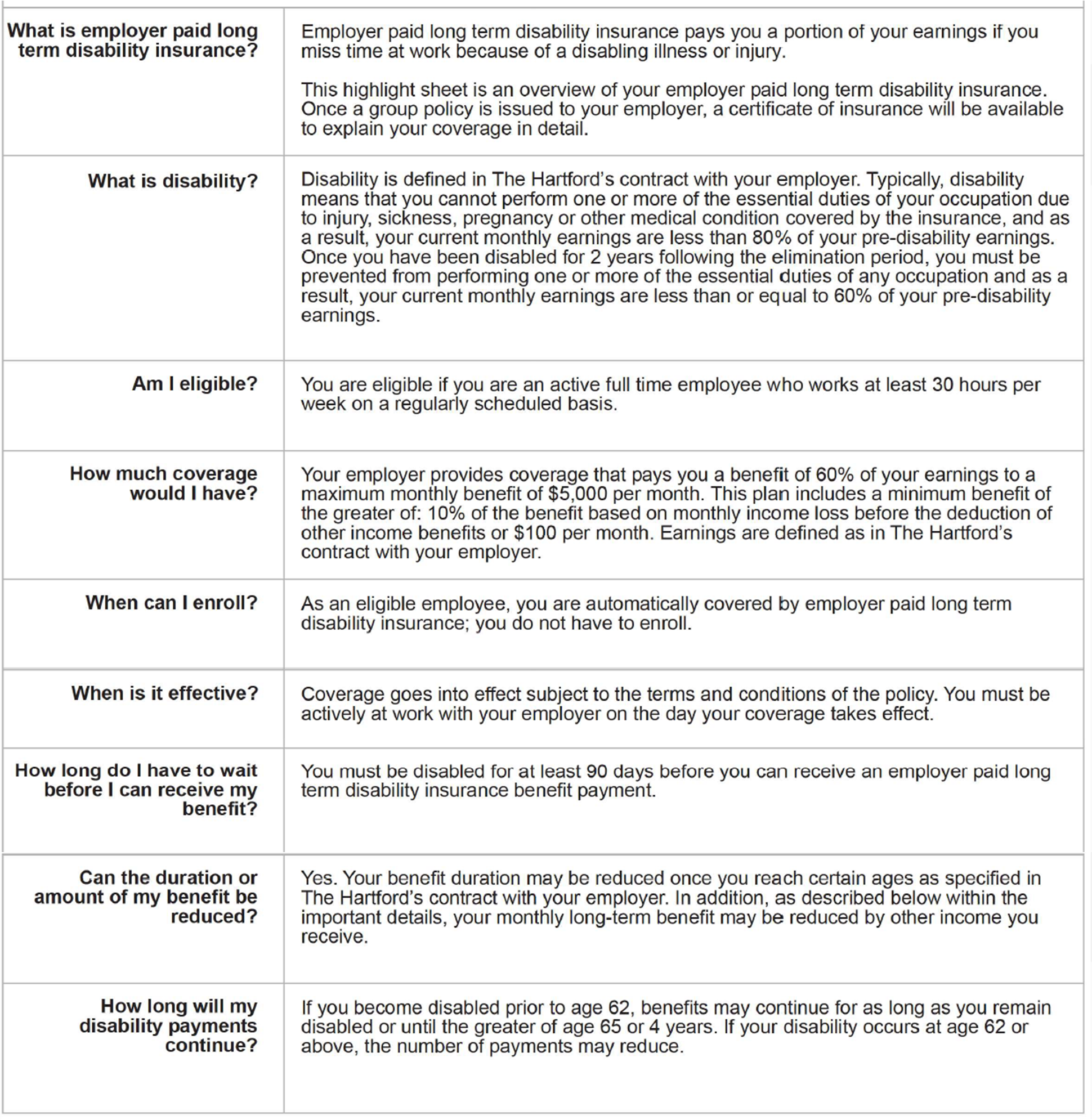

Basic Life and AD&D Coverage are paid for 100% by the Employer

$50,000

Basic Life and AD&D

Additional Value Added Services

![]()

CAN I MAKE MID-YEAR PLAN CHANGES TO MY GROUP HEALTH INSURANCE?

An employer’s ability to allow employees to cancel or change health plan elections is governed by the Internal Revenue Code. Section 125 of the Internal Revenue Code (IRC) governs how employers provide benefits to employees on a pre-tax basis. After an employee has made an initial enrollment election, Section 125 does not permit changes outside of yearly open enrollment except for certain, specific reasons. The permitted Section 125 changes are the qualified “change-of-status” events described below:

QUALIFYING LIFE EVENT (QLE)

A change in your situation — like getting married, having a baby, or losing health coverage — that can make you eligible for a Special Enrollment Period, allowing you to enroll in health insurance outside the yearly Open Enrollment Period.

There are 4 basic types of qualifying life events. (The following are examples, not a full list.)

- Loss of health coverage

-

- Losing existing health coverage, including job-based, individual, and student plans

- Losing eligibility for Medicare, Medicaid, or CHIP

- Turning 26 and losing coverage through a parent’s plan

- Changes in household

-

- Getting married or divorced

- Having a baby or adopting a child

- Death in the family

- Changes in residence

-

- Moving to a different ZIP code or county

- A student moving to or from the place they attend school

- A seasonal worker moving to or from the place they both live and work

- Moving to or from a shelter or other transitional housing

- Other qualifying events

-

- Changes in your income that affect the coverage you qualify for

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder

- Becoming a U.S. citizen

- Leaving incarceration (jail or prison)

- AmeriCorps members starting or ending their service

- See all qualifying life events

IMPORTANT PATIENT PROTECTION AND AFFORDABLE CARE ACT NOTICES, ERISA NOTICES AND CONTACTS FOR MORE INFORMATION

Your Employer is providing these important notices to you at no fee. The notices in this package describe important rights that you have under the terms of the Group Health Plan. If you have any questions or need additional information regarding these notices you can contact:

Your Employer Representative

Sarah Watts

480-892-0056 Ext 102

sarah@gilbertchamber.com

or by mail at

119 N. Gilbert Rd. Ste 101

Gilbert, AZ 85234